Content

- Fca Sandboxes: A Fifth Of Firms That Participate In The Programme Have Gone Out Of Business

- Dbs Anz Transfer

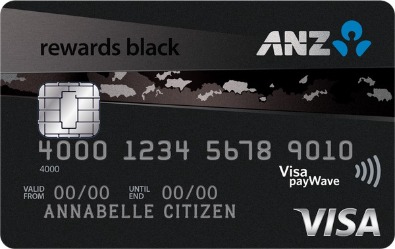

- Anz Debit Card Overseas Fees

- Related To Anz Gold Credit Card

- How Knitwear Designer Anz Developed The Viral Sweater With Just A Nudge To Current World Affairs

- Uk Smes Gain instant, Single Click Lending Via Embedded Finance

That same year, the bank received a full commercial banking licence and opened a branch in Frankfurt, Germany, and announced ANZ Singapore Limited. In 1988, ANZ opened branches in Rarotonga, Cook Islands and Paris, France. In 1951, the Bank of Australasia merged with Union Bank of Australia to form the Australia and New Zealand Bank Limited . In 1963, the first computer systems established in new data processing centre in Melbourne, Australia. In 1968, ANZ opened an office in New York, USA. In 1969, ANZ established a representative office in Tokyo, Japan.

There is a delay or error in accepting the instructions caused by the financial institution to which the transfer is to be made. ANZ may notify you of any electronic transactions it is unable to process. ANZ may delay acting on or may ask you for further information before acting on an instruction. Where ANZ has instructions for more than one payment from your account, ANZ will determine the order of priority in which payments are made. Any electronic transaction made by you cannot be cancelled, altered or changed by you unless allowed by the applicable terms and conditions or this section.

The interest that is debited to your account on a particular day will not include the debit interest accrued in respect of that day. Debit interest charged Debit interest will accrue daily on the overdrawn balance of your account as at the end of the day at the applicable daily interest rate. In those circumstances, we may make consequential adjustments to the balance of your account, including with respect to accrued interest or interest that has already been credited or debited to your account. If we receive a message through the New Payments Platform2 that a payment will be made to your account, we may credit the amount of the payment to your account even if we have not yet received the payment. If the payment is not received for any reason, we will reverse the transaction by taking the amount from your account. 6pm Melbourne time on a day on which banks in Melbourne or Sydney are able to effect settlement through the Reserve Bank of Australia when making a BPAY Payment. Blocking one or more direct debits may cause the merchant concerned to stop providing the relevant goods and services or may result in liability for you under any contract between you and the merchant.

Fca Sandboxes: A Fifth Of Firms That Participate In The Programme Have Gone Out Of Business

When the account is closed, we will send you a cheque for the net credit balance of the account. The Electronic Banking Conditions of Use in Section 8 set out additional security requirements in relation to electronic access processes, including your ANZ Access card and PIN. PLUS is an international ATM network through which you can access funds in your linked ANZ V2+Broking account by using your ANZ Visa card and PIN while overseas. Your ANZ V2+Broking account may be debited for the purposes of paying any of those fees and charges. It may not always be clear to you when use of your ANZ V2+Broking account is an International Transaction, for example where the merchant or financial institution making or processing a debit or credit is located outside of Australia. For an International Transaction using an ATM, the Overseas Transaction Fee is calculated on the value of the International Transaction and any ATM operator fee that applies to the International Transaction. The Overseas Transaction Fee is debited to your ANZ V2+Broking account at the same time as the debit or credit is processed to your account.

If you wish to alter the account authorisation instructions you must notify us in writing. Where we send you a document by mail, or send notice to you by mail that a document has been published on our website or in ANZ Internet Banking, you are deemed to have received the document on the seventh day after mailing. For the purposes of providing such written notice, we will rely on your contact information shown in our records, which may be the contact details of your adviser. To authorise a third party signatory to use ANZ Phone Banking and ANZ Internet Banking in connection with your account, you will also need to complete a separate ANZ Phone Banking and ANZ Internet Banking Authorised User Authority. In accordance with the Privacy Act, we will keep your TFN, which we can keep a record of for all your accounts, confidential. Federal legislation requires us to verify the identity of all account holders, signatories and agents. Any account holders, signatories and agents must satisfactorily meet our Customer Identification Process.

If you have any general inquiries about this booklet or the terms and conditions contained within it, or simply need more information about any ANZ account, please ask at any ANZ branch or phone our ANZ V2 PLUS Service Centre. Any shortfall from the sale of the financial products by CMC Markets will remain a debt due by you to us, in respect of which you indemnify us and in relation to anz business owner credit card which this Section 2.12 will apply. 3 Osko means the Osko payment service provided by BPAY Pty Ltd using the New Payments Platform. We may process transactions received by us on a particular day in any order we see fit. This means that the order of processing transactions on a day may vary from the order in which transactions are made on that day or are received by us on that day.

Dbs Anz Transfer

Online Ease—Increasingly, business owners make purchases and do business online with vendors, contractors, and suppliers. “The most important step a small business can take to make sure credit cards are used effectively is to set up a bomb-proof accountability system,” says John Burton, founding partner of Moonshadow Leadership Solutions in Bryson City, N.C. Boasting a handful of further «wins» during the reported period, ANZ said its small business customers who use accounting software platforms can now apply for lending online and get funds within four days, reduced from 30 days.

During the early 1980s monetary authorities in Australia and New Zealand gradually began to relax the controls that had limited banking operations since the 1950s. This, together with a strenuous program of cost-cutting, led to a substantial increase in profits. But deregulation of the industry also opened Australia and New Zealand to foreign banking. In response to this foreign competition, as well as increased domestic competition, ANZ decided to try to buy strength and diversity.

Late in 2001, for example, the bank bolstered its Asia-Pacific retail banking unit through the purchase of the Bank of Hawaii’s operations in Papua New Guinea, Vanuatu, and Fiji for about A$100 million. Then in May 2002 came the first major joint venture deal to follow the new growth formula. That month ANZ combined its Australian and New Zealand funds management operations with ING Group’s funds management and life insurance businesses in Australia and New Zealand, forming ING Australia Limited. The new venture was 51 percent owned by Netherlands-based financial services giant ING and 49 percent by ANZ, but the two owners were to have equal say in the management. ING Australia instantly became the fourth largest retail funds manager in Australia, with A$38.4 billion of funds under management, and the number five life insurer. The main point of logic behind the deal was that it would bring together ING’s funds management experience with the power of ANZ’s bank distribution channels.

Anz Debit Card Overseas Fees

ANZ is committed to sustainable finance for institutional customers transitioning to a low-carbon economy. As of 2021, ANZ has concluded around A$22 billion worth of sustainable finance transactions. In June 2021, ANZ closed Australia’s first sustainability-linked bond in the domestic debt market. In August 2021, ANZ launched sustainability-linked derivatives in Australia, Hong Kong, Singapore and Japan. ANZ Credit Card accountmeans the current and valid credit facility provided by ANZ to which purchases made by cardholders on ANZ Credit Cards are charged.

ANZ will cancel it and arrange for you to select a new username, password, PIN or Telecode, or to be provided with a new CRN. The best way to make the report is to call ANZ on the telephone numbers listed in this booklet. BPAY Payment instructions received after 6pm Sydney time on a Banking Business Day, or on a day that is not a Banking Business Day, will be processed on the next Banking Business Day. Once this information is provided, ANZ will treat your instructions as valid and will debit the relevant account. ANZ will not be obliged to effect a BPAY Payment instruction if it is not made in accordance with these Conditions of Use or if the information given is incomplete and/or inaccurate.

Over the past two years ANZ has spent more than $1bn on compensating customers, the bank told the market. ANZ says it will take a $682m hit this year to compensate customers who it ripped off over the past decade, adding to a remediation bill that has already climbed into the billions across the scandal-plagued banking industry. “I am bringing the banks https://xero-accounting.net/ regularly before the house economics committee and they are being held to account for their actions and you are seeing real results,” Turnbull said on Sunday. But the government remains under pressure, with the Greens, Labor, Bob Katter, the Nick Xenophon Team, One Nation and independent Jacqui Lambie all in favour of a royal commission into the banks.

Related To Anz Gold Credit Card

ANZ has donated AUD$50,000 to the Red Cross, to support Tonga’s rebuild, following the tsunami and volcanic eruption which caused damage to buildings and homes. Cash Management Accounts means the bank accounts of each Loan Party maintained at one or more Cash Management Banks listed on Schedule 8.01. If you want to borrow for business purposes, the ANZ Business Home Loan is available as a floating or fixed interest rate loan, secured against your home or other residential property.

The PayID may be registered by another user if they can demonstrate they have the right to use it, and payments using this PayID will then be made to the other user’s account. A PayID is a smart address used to receive payments through the New Payments Platform instead of using your account number and BSB. You may be able to create an optional PayID by linking your eligible ANZ account to an eligible PayID type (such as your mobile number, email address or ABN ). A PayID linked to your ANZ account can be used by others to make payments to you through the NPP without having to enter your account number and BSB, where they are permitted to do so by their financial institution. You must have authority to use any PayID you create and to link it to your ANZ account, and we may require proof of this. Impose, remove or change your daily or other periodic limit on transactions, an account or electronic equipment .

- ANZ serves around six million customers at over 570 branches in Australia.

- «Following the trends of the first quarter, all parts of our business performed well. Costs were down 2% and we also increased investment in new digital capability that will provide ongoing productivity improvements and better customer outcomes,» Elliott added.

- A cash withdrawal or purchase made via EFTPOS within Australia from or using your ANZ V2+Broking account.

- All currency conversion is done using the mid-market exchange rate, with just a small transparent fee.

- After ANZ cut its platinum card by 2% to 11.49% on Saturday, Buchholz said ANZ showed commercial courage in making the move, which would cost the bank $25m a year.

Buchholz, a member of the parliamentary economics committee, has recommended any credit card customers unhappy with their current interest rates move to the ANZ. If you’re unsure which card type might work for you, you can also consider a business debit card. Unlike a credit card, there is no risk of employees running up bills they can’t pay – and no credit check required.

Payment reversal or credit card reversal is somewhat of a broad term, but whether you’re dealing with authorization reversals, refunds, or chargebacks, they all have different applications and consequences for your business. If you or your employees notice something incorrect after submitting the authorization request, you can call your bank to stop the transaction from occurring. This is known as an authorization reversal, and it’s highly preferable over a future chargeback or refund. The further a payment gets along it’s path to completion and the more entities it communicates with (issuing bank, card network, etc.), the more of a hassle it is to take back. Security Issues—Security measures should be created to ensure that cards or card information are not stolen by employees, vendors, contractors, and others who come through the office space.

How Knitwear Designer Anz Developed The Viral Sweater With Just A Nudge To Current World Affairs

Any standing authority given by you to other parties such as monthly debits for life insurance must be cancelled directly by you with the other party. You should provide new payment details to the party if you want to continue to make payment this way. Alternatively, or if our telephone reporting service is unavailable, you should report the loss or theft to any ANZ branch. When a telephone report is made, we will give you a notification number or some other form of acknowledgement. You should retain this as evidence of the time and date of your report.

With the discovery of copper and lead deposits north of Adelaide in 1844, the colonies began moving out of the depression. The discovery of gold near Bathurst, New South Wales, in 1851 soon produced a general boom. In these new economic circumstances, gold and foreign-exchange dealing became significant banking services, and branch-banking programs flourished with the influx of new mining customers eager for mortgages. If your business is in rentals or anything that the final rate is determined by time instead of upfront, you should consider using incremental authorizations. These basically continue to set up transactions over time instead of waiting until the end to slap a big charge on a card — reducing the pain of a chargeback.

The resulting Australia and New Zealand Banking Group Limited became the third largest bank in the commonwealth, double the size of the fourth-place bank. Unfortunately, despite its expanded presence in the marketplace, ANZ saw its profits fall and its expenses rise during its first years, primarily because of a lax administration and unexpectedly high merger costs.

ANZ has been praised as ‘courageous’ by Coalition members for deciding to drop its credit card interest rates. ANZ said it increased the number of New Payments Platform payments for other banks by 115% when compared with the same period in 2020, and also introduced the ability for customers to track cross-border payments via its digital platforms. The business focused cards on offer from ANZ come with different features, including rewards or extended interest free payment³. The partnership has created a lot of value for both parties as it transformed MCC into a market leader with more than 1.5 Million cards-in-force, offering diverse products on payment solutions.

Uk Smes Gain instant, Single Click Lending Via Embedded Finance

We’ll also introduce the Wise Business multi-currency Mastercard as a smart alternative to a corporate card from your normal bank – especially if you travel for work. Metrobank Card Corporation started as Unibancard Corporation in 1985. In 2003, a joint venture was formed between Metrobank and ANZ Funds Pty Ltd , holding 60% and 40% stake of the business, respectively.

The unintended recipient consents to return of the funds, the Receiving Bank may forward the funds to ANZ, unless the payment was processed through the New Payments Platform or Osko, in which case the Receiving Bank may return the funds. Additional authentication requirements To help protect the security of your account, ANZ may require you to comply with additional authentication requirements before processing a transaction . ANZ will decide in its discretion which transactions require additional authentication. If you are unable to comply with an authentication request or if the system through which the authentication is done malfunctions or is unavailable for any reason, ANZ may not be able to process a transaction. If you recover the lost or stolen card, you must destroy the card by cutting it diagonally in half and return it to an ANZ branch as soon as possible. Lost or stolen cards, Password, PIN or Telecode If you report that a card has been lost or stolen the card will be cancelled as soon as the report is made. A card must be signed immediately by the person in whose name it has been issued and must only be used within the `valid from’ and `until end’ dates shown on the card.

ANZ will attempt to ensure a BPAY Payment is processed promptly by billers and other participants in the BPAY Scheme. You may also incur charges from your mobile operator as a result of using ANZ Mobile Banking. `BPAY Payments’ means the BPAY Payments service provided by BPAY Pty Ltd. `Banking Business Day’ means any day from Monday to Friday that is not a national public holiday. When we cancel an ANZ Access card, or receive instructions to cancel an ANZ Access card, the card must not be used and must be returned to us cut diagonally in half . In the event that you or your adviser closes your CMC Markets Trading Account, your ANZ V2+Broking account will be closed on the terms set out in Section 7.2.